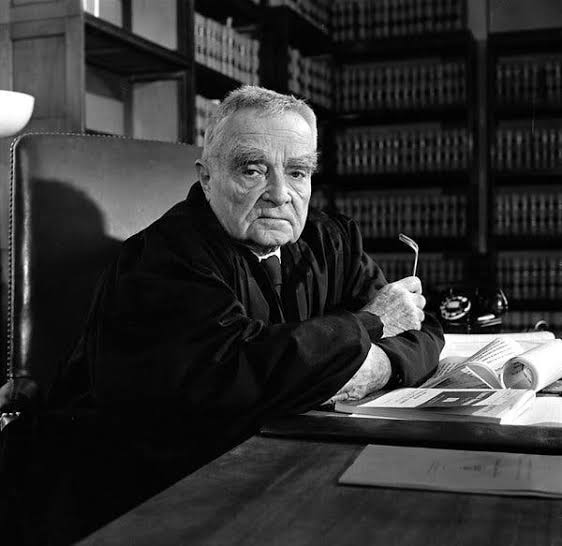

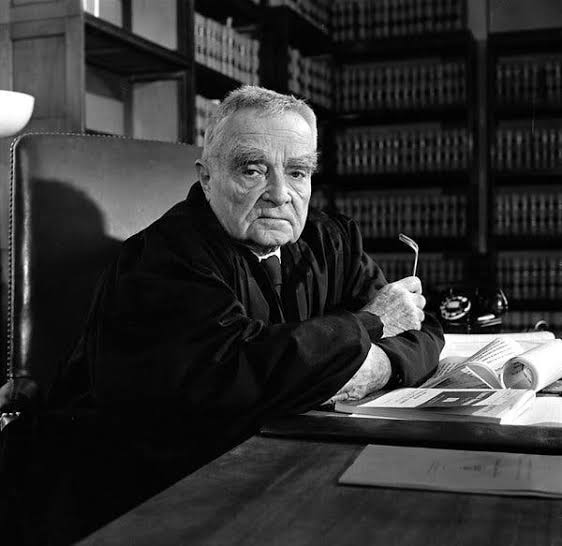

Judge Learned Hand

Chief Judge of the United States Court of Appeals

for the Second Circuit

Gregory v. Helvering, 69 F

Learn about the Waters Edge Election's impact on local businesses in Apple Valley, Victorville, Hesperia, and Barstow.

For business owners in Apple Valley, Victorville, Hesperia, and Barstow, understanding the Waters Edge Election can be crucial for effective tax planning and compliance in California. This election allows multinational corporations to limit their California taxable income to their U.S. operations, which can result in significant tax savings. Here's what you need to know about how this works and how it can benefit your business.

The Waters Edge Election is an option for multinational corporations to apportion their income based solely on their U.S. operations. This can be particularly advantageous for companies with significant overseas operations, as it can reduce the overall tax burden in California. By electing this option, businesses can exclude foreign income and only include income from U.S. operations in their California tax base.

According to the IRS, this election involves specific filing and compliance requirements that businesses must adhere to (source).

To qualify for the Waters Edge Election, businesses must file Form 100-WE with the California Franchise Tax Board. This form outlines the income to be excluded and ensures compliance with state regulations. It is important to note that once made, the election is binding for a period of seven years, so careful consideration and strategic planning are essential.

Additionally, businesses must maintain accurate and detailed records to support their election and demonstrate compliance with both state and federal tax laws.

The primary benefit of the Waters Edge Election is the potential reduction in California tax liability, particularly for businesses with substantial international operations. By excluding foreign income, companies can focus on optimizing their U.S.-based earnings. This can lead to substantial savings and increased financial flexibility.

Moreover, electing the Waters Edge can simplify tax reporting and reduce the risk of audits related to foreign income. However, businesses should consult with a tax professional to ensure that this election aligns with their overall tax strategy.

For businesses in Apple Valley, Victorville, Hesperia, and Barstow, understanding the nuances of the Waters Edge Election requires local expertise and support. At TaxHelpGuy.com, our team is well-versed in California tax laws and can provide tailored advice to help you maximize your tax benefits. Whether you need assistance with tax preparation, tax resolution, or audit defense, we're here to help. Contact us at (760) 249-7680 to schedule a consultation.

For more information on tax compliance and planning, explore our tax services, tax resolution options, and audit defense services.

Can’t find the answer you’re looking for? Reach out to our customer support team.