Welch v. Helvering: The Classic Definition of "Ordinary and Necessary" Business Expenses

Case Summary

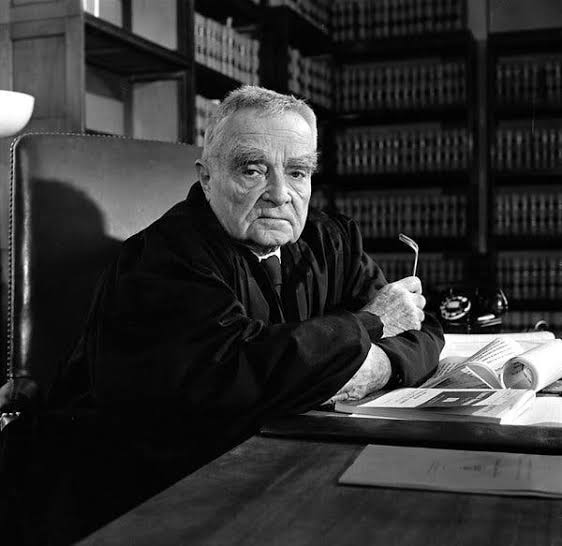

Welch v. Helvering is one of the most quoted tax cases in history, featuring beautiful judicial language from Justice Benjamin Cardozo. It established the framework for determining whether business expenses are "ordinary and necessary" under what is now IRC § 162(a), the most important business deduction provision in the tax code.

The Facts of the Case

Thomas Welch worked for E.L. Welch Company, a grain business. When the company went bankrupt in 1922, it couldn't pay its creditors. Welch was not personally liable for these business debts—he had no legal obligation to pay them.

However, in 1924-1928, Welch voluntarily paid approximately $20,000 to satisfy the old debts of the bankrupt company. He made these payments to restore his reputation and business standing in the grain industry so he could continue working in the field.

Welch tried todeduct these payments as ordinary and necessary business expenses, arguing they were necessary to maintain his business reputation.

The IRS disagreed, arguing the payments werenot deductiblebecause they were capital expenditures to build his personal reputation and goodwill.

The Supreme Court's Decision

The Ruling: No Deduction

The Supreme Court sided with the IRS, holding that Welch's payments were NOT ordinary and necessary business expenses. While the payments might have been "necessary" for his business success, they were not "ordinary" in the tax law sense.

Justice Cardozo's Famous Analysis

Justice Benjamin Cardozo wrote one of the most quoted passages in tax law:

"Ordinary in this context does not mean that the payments must be habitual or normal in the sense that the same taxpayer will have to make them often. A lawsuit affecting the safety of a business may happen once in a lifetime. The counsel fees may be so heavy that repetition is unlikely. Nonetheless, the expense is an ordinary one because we know from experience that payments for such a purpose, whether the amount is large or small, are the common and accepted means of defense against attack. The situation is unique in the life of the individual affected, but not in the life of the group, the community, of which he is a part."

The Two-Part Test

The Court established that to be deductible, an expense must be BOTH:

- "Necessary":Appropriate and helpful for the business

- "Ordinary":Normal, common, and accepted in that type of business

Understanding "Ordinary"

What "Ordinary" DOES Mean:

- Common in the industry:Other businesses in your field incur similar costs

- Accepted business practice:The expense is a normal way to conduct that type of business

- Customary:It's the kind of expense people in your business typically have

- Not extraordinary:It's not highly unusual or unexpected in your field

What "Ordinary" Does NOT Mean:

- Frequent:The expense doesn't have to occur regularly or repeatedly

- Small:Large expenses can still be ordinary

- Predictable:Unexpected expenses can be ordinary if they're common in the industry

- Your personal habit:It doesn't matter if YOU do it often; it matters if others in your business do

The Cardozo Test: "Life of the Group"

The key question is:Is this expense ordinary in the life of the community/industry, even if it's unique in your individual experience?

Examples:

- Defending a major lawsuit might happen only once to you, but it's ordinary for businesses generally → DEDUCTIBLE

- Paying off your former employer's debts is highly unusual even for your industry → NOT DEDUCTIBLE

Understanding "Necessary"

What "Necessary" DOES Mean:

- Appropriate and helpful:The expense assists your business

- Has business purpose:There's a legitimate business reason for the expense

- Related to business activities:Connected to your trade or business

What "Necessary" Does NOT Mean:

- Absolutely essential:The business doesn't have to fail without it

- Required by law:You don't have to be legally compelled to pay it

- The only option:There can be other ways to achieve the same goal

- Reasonable in amount:Even excessive expenses can be "necessary" (though amounts might be questioned)

Real-World Applications: Is It Deductible?

✅ ORDINARY and NECESSARY (Deductible):

1. Legal Fees to Defend Business Lawsuit

- Necessary?YES - Defending your business is appropriate and helpful

- Ordinary?YES - Businesses commonly face lawsuits and hire attorneys

- Result:DEDUCTIBLE

2. Advertising Costs for New Business

- Necessary?YES - Advertising helps attract customers

- Ordinary?YES - All businesses advertise

- Result:DEDUCTIBLE

3. Professional Liability Insurance

- Necessary?YES - Protects your business from claims

- Ordinary?YES - Common for professionals to carry insurance

- Result:DEDUCTIBLE

4. Employee Training Programs

- Necessary?YES - Improves employee skills for current job

- Ordinary?YES - Employers commonly train employees

- Result:DEDUCTIBLE

❌ NOT Ordinary and/or NOT Necessary (Not Deductible):

1. Welch's Situation: Paying Former Employer's Debts

- Necessary?MAYBE - Helped his reputation

- Ordinary?NO - Highly unusual; people don't typically pay debts they don't owe

- Result:NOT DEDUCTIBLE (capital expenditure for goodwill)

2. Country Club Dues

- Necessary?MAYBE - Could help network and find clients

- Ordinary?MAYBE - Some businesspeople use clubs

- Result:NOT DEDUCTIBLE (specifically prohibited by IRC § 274)

3. Fines and Penalties

- Necessary?NO - Violating laws isn't appropriate for business

- Ordinary?Doesn't matter

- Result:NOT DEDUCTIBLE (against public policy)

4. Personal Expenses

- Necessary?NO - Personal benefit, not business

- Ordinary?Doesn't matter

- Result:NOT DEDUCTIBLE

The Gray Areas: Borderline Cases

1. Business Suits and Professional Clothing

General Rule:NOT deductible (personal expense)

Exception:Uniforms or specialized clothing not suitable for everyday wear (e.g., chef's whites, safety gear) ARE deductible

Why:Regular business clothes serve a personal function (covering your body) even if you wouldn't buy them otherwise

2. Home Office Expenses

General Rule:Can be deductible if you meet strict requirements

Test:Must be used regularly and exclusively for business, and either:

- Principal place of business, OR

- Place where you meet clients/customers

Ordinary and Necessary?YES - Many businesses operate from home offices

3. Commuting Costs

General Rule:NOT deductible (personal expense)

Exception:Travel between job sites, or from home office to client location IS deductible

Why:Commuting to your regular workplace is personal; business travel is different

4. Entertainment Expenses

Pre-2018:50% deductible if directly related to business

Post-2017 Tax Reform:Generally NOT deductible

Exception:Business meals are still 50% deductible (100% for 2021-2022 due to COVID relief)

Modern Applications of the Welch Standard

1. Cryptocurrency and NFT Businesses

Question:Are crypto transaction fees ordinary and necessary?

Analysis:

- Necessary? YES - Required to conduct crypto transactions

- Ordinary? YES - All crypto businesses incur these fees

- Result: DEDUCTIBLE

2. Social Media Influencer Expenses

Question:Are costs for professional makeup/hair styling deductible?

Analysis:

- Necessary? MAYBE - Helps create content

- Ordinary? MAYBE - Common for influencers, not for general population

- Result: LIKELY DEDUCTIBLE if exclusively for filming/content creation

3. Cybersecurity Insurance

Question:Is cyber liability insurance deductible?

Analysis:

- Necessary? YES - Protects against data breaches

- Ordinary? YES - Increasingly common for all businesses

- Result: DEDUCTIBLE

The Importance of Documentation

To prove an expense is ordinary and necessary, you should document:

- Business Purpose:Why did you incur this expense?

- Business Benefit:How does it help your business?

- Industry Practice:Do others in your field have similar expenses?

- Amount:Receipts and records of what you paid

- Date:When the expense occurred

Common Documentation Mistakes

Mistake #1: No Business Purpose Written Down

Writing "business expense" on a receipt isn't enough. Note specifically why it was necessary for your business.

Mistake #2: Mixed Personal/Business Use

If an item serves both personal and business purposes, you can only deduct the business portion. Keep detailed logs.

Mistake #3: Excessive Amounts

Even if an expense is ordinary and necessary, the IRS can question whether the amount is reasonable. A $1,000 lunch meeting will raise eyebrows.

Mistake #4: No Contemporaneous Records

Keep records at the time of the expense. Recreating them years later during an audit looks suspicious.

The Relationship to Other Tax Concepts

Ordinary and Necessary vs. Reasonable

The tax code requires expenses to be ordinary and necessary, but the IRS can also question if amounts are "reasonable." All three concepts work together:

- Ordinary:Common in your industry

- Necessary:Appropriate and helpful

- Reasonable:Not excessive in amount

Ordinary and Necessary vs. Capitalization

Even if an expense is ordinary and necessary, you might have to capitalize it rather than deduct it currently if it:

- Creates a lasting benefit

- Acquires or improves an asset

- Has benefits extending substantially beyond the current year

Key Takeaways from Welch v. Helvering

- "Ordinary" Doesn't Mean Frequent:An expense can be ordinary even if you incur it only once

- Industry Standards Matter:Look at what's common in your field, not just your personal experience

- "Necessary" Is Generous:You don't have to prove the expense was absolutely essential

- Both Tests Must Be Met:The expense must be BOTH ordinary AND necessary

- Documentation Is Critical:Be prepared to explain why your expense meets both tests

How Tax Help Guy Can Help

At Tax Help Guy, we help business owners maximize legitimate deductions:

- Expense Review:Analyze your expenses to identify deductible items

- Documentation Systems:Set up record-keeping to support deductions

- Audit Defense:Defend your business expenses if the IRS questions them

- Tax Planning:Structure expenses to maximize deductibility

- Industry Research:Help prove expenses are ordinary in your field

Are You Missing Business Deductions?

Many business owners either miss deductions they're entitled to or claim deductions they shouldn't. We'll help you get it right and maximize your tax savings.

Schedule Your Business Tax Review